when will capital gains tax rate increase

The IRS recently released the new inflation adjusted 2023 tax brackets and rates. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase.

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

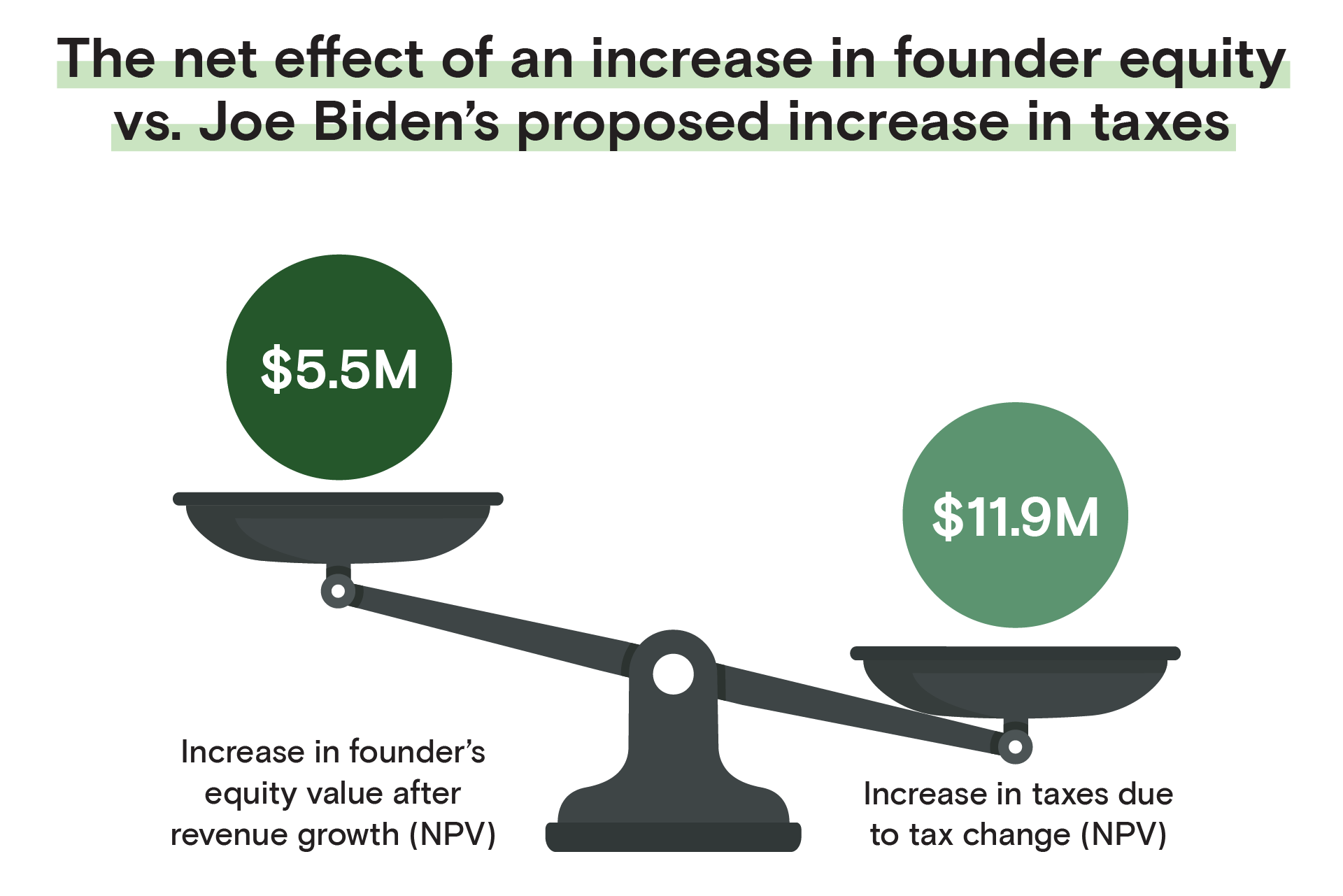

President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from.

. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. Tax filing status 0 rate 15 rate 20 rate.

House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. Both have proposed increasing tax rates for capital gains as one potential way to generate revenue for this purpose. First deduct the Capital Gains tax-free allowance from your taxable gain.

The maximum zero rate amount cutoff is 83350. Taxable income of up to 40400. 13350 of the qualified dividends and long-term capital gains 83350 70000 is taxed at 0.

A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. With average state taxes and a 38 federal surtax the. Taxes and Asset Types -.

2022 capital gains tax rates. The effective date for this increase would be September. 2021 Long-Term Capital Gains Tax Rates.

The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Long-term capital gains or appreciation on assets held for. 100000 of the capital gains would be taxed at the current long-term capital.

2021 capital gains tax calculator. Sell assets in a low tax year Under current tax law the first 80000 of long-term capital gains can be taxed at a 0 rate. President Biden wants to increase the long-term capital gains tax for wealthier Americans.

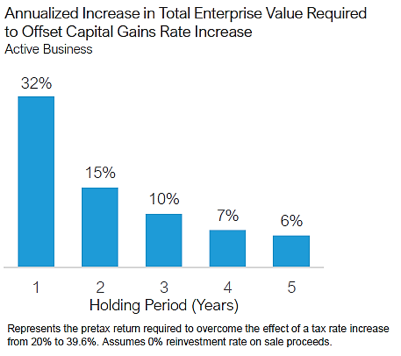

The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

The proposal would increase the maximum stated capital gain rate from 20 to 25. Explore updated credits deductions and exemptions including the standard deduction. The effective date for this increase.

From 1954 to 1967 the maximum capital gains tax rate was 25. Add this to your taxable. For single filers with taxable income of.

The proposed increase would tax long-term gains over 1 million as ordinary income which means that these high-income investors would have to pay a top rate of 396. For married couples filing jointly the standard deduction will rise to 27700 up from 25900 in the current tax year. Note that short-term capital gains taxes are even higher.

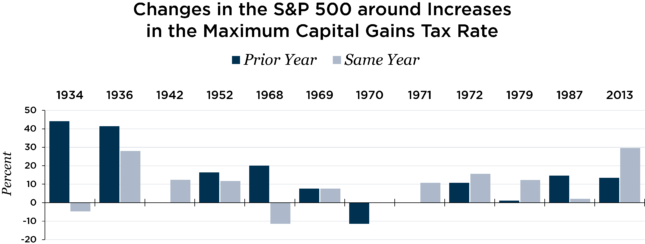

Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Assume the Federal capital gains tax rate in 2026 becomes 28.

Unlike the long-term capital gains tax rate there is no 0. The effective date for this increase would be September 13 2021. Capital Gains Tax.

In 1978 Congress eliminated. Capital Gains Tax Rate. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Currently the capital gains rate is 20 for.

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

For Founders The Implications Of Joe Biden S Proposed Tax Code

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Managing Tax Rate Uncertainty Russell Investments

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Stocks Retreat On Capital Gains Plan Nationwide Financial

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Mapped Biden S Capital Gain Tax Increase Proposal By State

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Democrats Propose Higher 25 Capital Gains Tax Rate Here Are 3 Ways To Minimize The Potential Hit Bankrate

A Near Doubling Of The Capital Gains Tax Rate May Be On The Horizon Wealth Management

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Short Term Capital Gains Tax Rates For 2022 Smartasset

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Managing Tax Rate Uncertainty Russell Investments

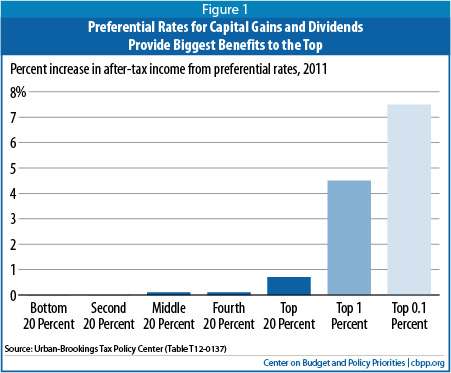

Raising Today S Low Capital Gains Tax Rates Could Promote Economic Efficiency And Fairness While Helping Reduce Deficits Center On Budget And Policy Priorities

Biden Capital Gains Tax Increase Proposed How To Save On Taxes

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)